Christmas £20 Virtual Gift

Looking for a special Christmas gift that will do good this year?

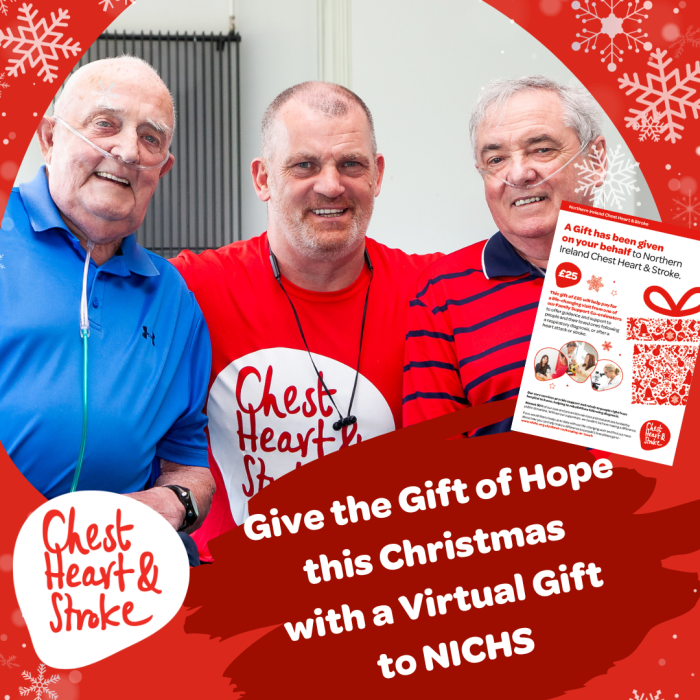

Our online virtual gift includes a pdf certificate which you can download and print off to acknowledge the amazing contribution you’ve made to our support services.

Your gift will give the Gift of Hope to people affected by chest, heart and stroke conditions this Christmas and beyond - hope for future generations, for a better recovery, for support for everyone who needs us, and for ground-breaking research advancements.

The care services we supply provide support from hospital to home, right through to rehabilitation services which help rebuild lives.

Almost 90% of our care and preventions services and research are funded by donations. Without our supporters we couldn’t be here making a difference.

This gift of £20 will help pay for a Breathing Better Co-ordinator to deliver a four-week, two-hour respiratory education session. It will help people with these conditions to better understand their condition, improve their personal confidence and motivation, as well as providing specialist information to empower individuals to make positive life-style changes.

How to purchase a Virtual Christmas Gift:

- Click on ‘Add to Basket’

- Fill in the information to complete the checkout process

- Once you have completed the checkout process you will receive an automatic email with a link to the Virtual Gift PDF. Please note - this email may take up to 30 minutes to arrive in your inbox.

- You can either print this out and include it in a card or simply email it if you aren’t able to visit your loved one this Christmas.